Data-driven transformation in Insurance

Reducing risk and boosting retention

Increase your exposure to insight

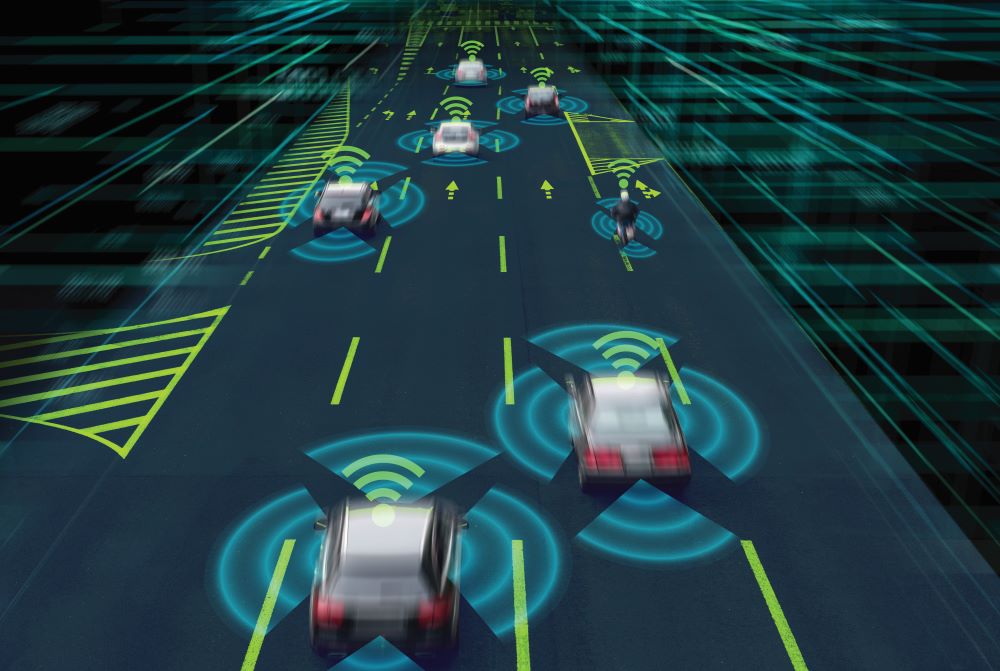

Insurance is one of the most competitive – and least predictable – sectors. Data science and big data revolutionises how the industry approaches risk, enabling insurers to develop effective attraction and retention strategies while combating fraud.

TRANSFORMING INSURANCE RISK

How do we provide competitive polices that cover our risk? What are the fastest ways to detect and mitigate cyber attacks? How can we prevent fraud?

Predicting the future is hard enough. Insurance companies must also attract increasingly price sensitive customers while defending market share against aggressive competitors. And it’s not just profits that are at risk; data itself is under threat. Cyber attacks and fraud are only becoming more frequent, more sophisticated and harder to prevent.

Mango Solutions enables insurance companies to transform the way they assess customers’ risks – while reducing their own. Leveraging data from a wide array of sources enables insurers to devise optimally priced premiums and price sensitivity according to the customers’ ever-evolving profile, while automatically detecting fraudsters.

How Mango Solutions helps insurance companies

We draw on our market expertise and data science skills to deliver value from your transformation and use cases.

- Transforming legacy systems – working with emerging API technologies to future-proof insurance IT systems while understanding the effects on customer segmentation, process, channels, people and the organisation as a whole.

- Pricing automation – shifts towards algorithmic accountability are being used to assess each individual’s loyalty, level of risk and sensitivity to price. With more stringent regulations in place, there is now more scrutiny than ever on insurers to audit, evidence and explain the ways they calculate risk and price whilst helping them stay competitive.

- Detecting and preventing insurance fraud – deploying pattern recognition to analyse claims histories, together with social media sweeps and analysis of individuals with unusual behaviour to build a picture of ‘normal’ activity and provide real-time, full-featured fraud forecasts.

- Next best action strategies – creating and deploying recommender engines to consider the next best step for customer interactions, from marketing activities to call centre applications to predict cross sell and upsell opportunities

- Resource and Claims Management – using time series analysis to predict spikes in demand for resource handling and ensure an optimal claim process is presented and can be used by any adjuster.

Ready to embrace data-driven transformation in insurance? Contact our Account Manager Ian Cassley for more information.

Ian Cassley

Get in touchResources

Explore the latest insights to inspire your next data science project.